The catchy take-away from the Thomson Reuters “2024 Report on the State of the US Legal Market” is that law firm leaders who don’t respond to the shifts in the legal market in the past 15 years may share a destiny with Pan Am.

The US airline, Pan Am, was the largest international carrier in the mid-20th century. Pan Am filed for bankruptcy in 1991, after decades of tremendous growth in air travel. For those who recall Pan Am, it’s a vivid illustration. You will see the tie-in below.

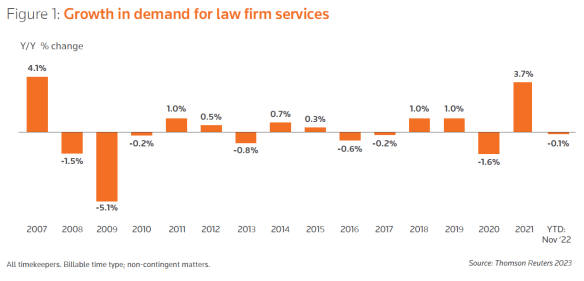

Looking at today’s legal market, the Thomson Reuters report is full of data and graphs which quantify recent trends.

Key Trends:

- There is a shift from the “Transactional Decade” of the 2010’s. Money was easy to borrow and transactional practices, including Corporate, M&A, and Real Estate climbed.

- More recently, the majority of growth is in counter-cyclical practices such as Litigation, Bankruptcy, and Labor & Employment.

3. The past few years have seen an aggressive increase in law firm rate growth. “In 2023, the rates clients agreed to pay law firms for new matters grew by more than 6%…”

4. At the same time, the collection rate on those fees is down. Clients are are moving tiered legal work to lower cost firms. This is where the Pan Am lesson comes in – respond to the market or get left behind.

While we are devouring graphs, let’s not stop there. If you are brave, take a look at a perennial favorite, profit per lawyer. The growth seen in the pandemic year of 2020 and the pandemic recovery year of 2021 have have not been repeated in the past two years.

I encourage you to download the report. The Thomson Reuters “2024 Report on the State of the US Legal Market” has 20 graphs and charts, including staffing, expenses, and, as you might expect, “Reaction to AI in the legal profession.”

Whether you are in a law firm, corporate legal, or legal tech, there is timely data here which you won’t find anywhere else. I’m sure that there are a couple of graphs which will be helpful in your next ops review.

-Maureen